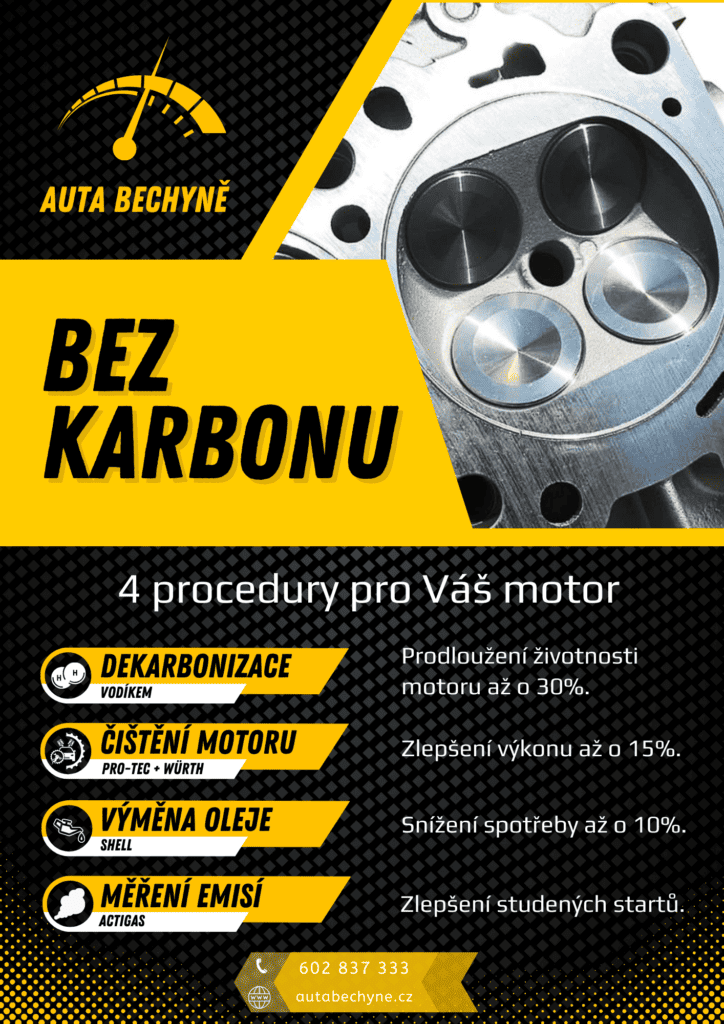

? “Motorcentrum Bechyně: Oživte svůj motor!” ?

U nás v Motorcentru vstupujeme do nové éry péče o vaše vozidlo. Představujeme vám naši novou službu – Komplexní čisticí servis pro váš motor. Nejenže prodloužíte životnost svého vozu, ale také zvýšíte jeho výkon a snížíte spotřebu paliva. A to vše v na jednom místě!

? Čištění motoru vodíkem – Vodík odstraní nahromaděný karbon a vrátí výkon vašeho motoru.

? Speciální chemické čištění motorů – Pro ty nejtvrdší usazeniny a pro maximální životnost.

? Výměna oleje – Po čištění následuje výměna oleje. Používáme oleje Shell.

? Měření emisí – Měření emisí před a po čištění motoru, abyste viděli rozdíl.

Nečekejte, až bude příliš pozdě! Odkarbonujte svůj motor a ušetřete si náklady díky. Rezervujte si svůj termín a budete mít do konce roku slevu 20%.

Více informací najdete:

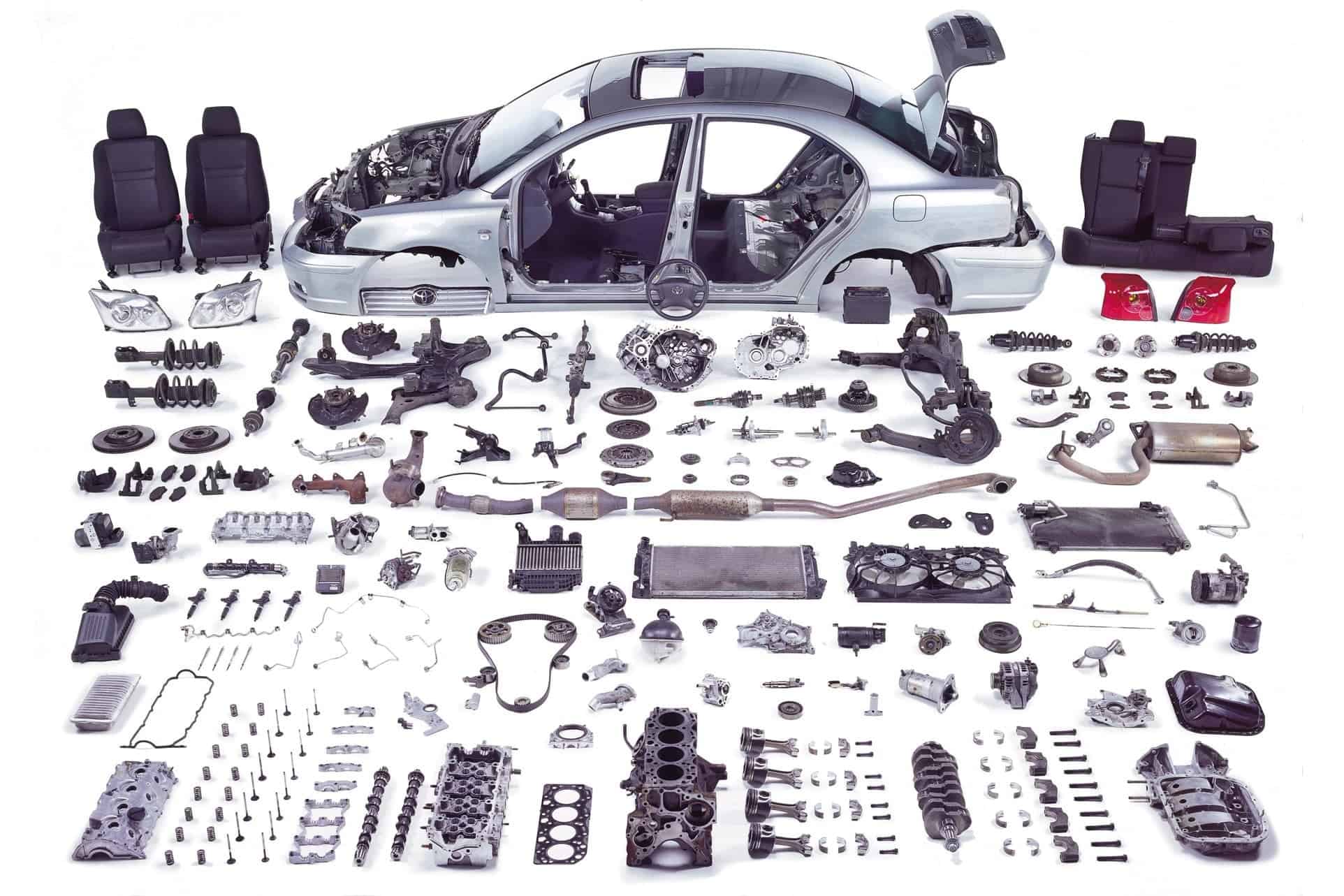

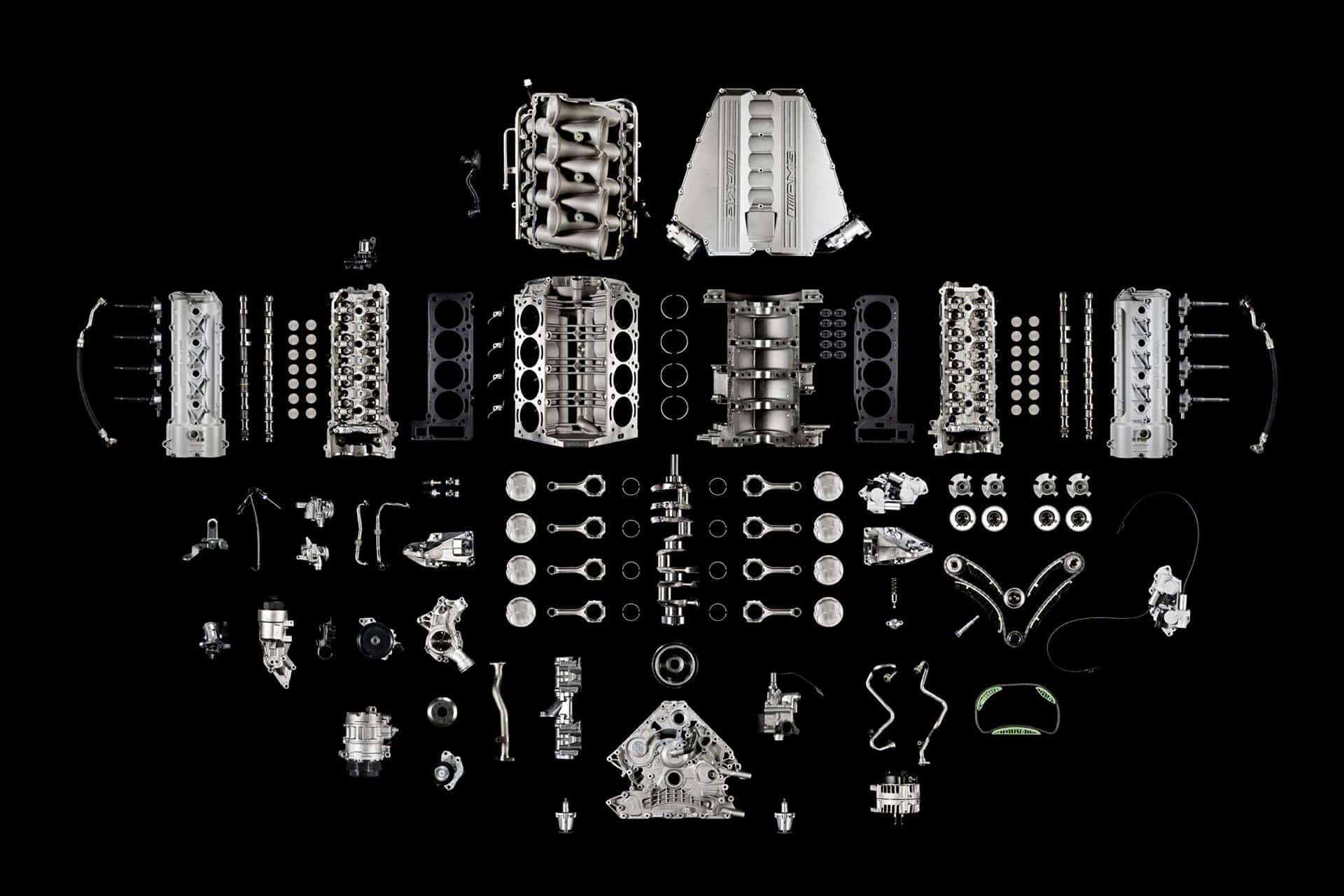

Vozidla na náhradní díly

________________________________________________________

* ve složkách můžete prohlížet nejaktuálnější databázi našich vozidel na náhradní dílyAutovrakoviště – Náhradní díly

Autovrakoviště Bechyně Vám nabízí široký sortiment nových, ale hlavně použitých náhradních dílů na všechny typy vozidel.

Sortiment vozidel je pravidelně obnovován výkupem havarovaných vozidel, ze kterých jsou nabízeny náhradní díly na našem autovrakovišti.

Autovrakoviště se nachází v Jižních Čechách v obci Bechyně. Ve vzdálenosti 24km od města Tábor a 45km od krajského města České Budějovice.

- Více než 500 vozidel na náhradní díly.

- Originální a levné náhradní díly na všechny typy vozidel.

- Kvalitní autoservis s nejmodernějším vybavením.

- Odtahy vozidel

- Výkup havarovaných vozidel

To vše kvalitně a profesionálně.

Neváhejte a kontaktujte nás!!

Ekologická likvidace vozidel

Provozujeme ekologickou likvidaci vozidel. Jsme držiteli oprávnění pro zpracování autovraků. Likvidace autovraků je u nás zdarma včetně odvozu.

Naše odtahovky:

- Volvo FL6 + hydraulická ruka

- Fiat Ducato – odtahový vůz

- Mercedes Sprinter – odtahový vůz

- a nebo klasika – Pajero s vlekem

Ekologická likvidace vozidel

Provozujeme ekologickou likvidaci vozidel. Jsme držiteli oprávnění pro zpracování autovraků. Likvidace autovraků je u nás zdarma včetně odvozu.

Naše odtahovky:

- Volvo FL6 + hydraulická ruka

- Fiat Ducato – odtahový vůz

- Mercedes Sprinter – odtahový vůz

- a nebo klasika – Pajero s vlekem

Zemní práce

Zajišťujeme odvoz sutí, odpadů a přepravu stavebních materiálů (cihly, tašky, písky, štěrky, kámen). Nakládání a vykládání břemen až do hmotnosti 5t a výšky 5m pomocí hydraulické ruky nebo bagru. Nabízíme možnost přistavení různých kapacit kontejnerů i na delší dobu. Např. pro vyklízení budov. Vykupujeme železo a barevné kovy. Vlastníme váhu nákladních vozidel v Bechyni, menší množství vážíme přímo v areálu vrakoviště.

Naši pracanti:

- MAN TGS 35.400 – nosnost 18t, nosič kontejnerů + hydraulická ruka

- Volvo FL nosnost: 7t + vlek – nosič kontejnerů + hydraulická ruka

- Rypadlonakladač Caterpillar 432E

- V3S – 3stranný skápěč

Naše auta na náhradní díly

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|